|

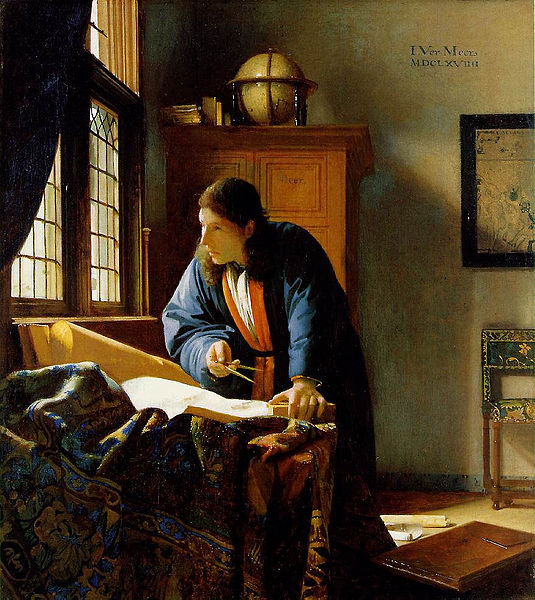

| Vermeer's "The Geographer" from wikipedia: the search for new knowledge |

This is the third in a series about research for IT and business: designed as a practical guide for those tasked with gathering the information needed to make better decisions, this article presents alternative, lower-cost research resources that should be part of every businessperson’s toolset.

By the time you’re talking about the research buys for a Global 2000 or Fortune 500 company, it’s not too unusual to see annual budgets of $200-500K. Tech research is big business. Say “research” in a business context, what comes to mind? Usually, some contact with one of the big research vendors, Gartner, Forrester, or IDC.

What are people asking for when they say “research?” Based on the requests I got from business and IT people over the years, it’s usually “vendor comparisons,” “benchmarking/ knowledge of what peers are doing,” “best practices,” and “planning/strategy.”

Ironically, for all those dollars spent, even the best of the commercial companies can only help you part of the way toward having good answers. In practice, no one company has the depth or impartiality to be your single source of information. In previous articles, I discussed ways to evaluate and choose from among the big companies as a research portfolio buy. But many companies will not choose to spend that kind of money.

Furthermore, just plain good practice for business suggests that the best decision support mechanism you can build should include not just “bought” sources, but also other voices motivated in different ways, and with different resources and different ideas.

In fact, benchmarking and peer practice, one of the most sought-after answers, is--in my opinion--only available in a paid way at the least granular, least useful level. I think you’ll be more successful, and get better answers, by following and communicating with peers than via paid research. The good news is, although the multiple-source approach needs more direct involvement from you it also comes with a dramatically lower price tag. If you can’t budget for the big research companies, these sources can go a long way; if you do have that budget, the chorus of voices giving you information will be much richer if you add these.

I recommend four information streams in addition to a paid research portfolio:

|

| HP Labs, 1501 Page Mill Road, Palo Alto CA. High tech from a midcentury flight of fancy |

- Strategic partners and other vendors: there is a lot of mutual self-interest between the companies that make technology and the people who buy it. At the simplest level, a vendor you are considering is usually happy to share Gartner or Forrester comparison reports with you, especially if they are favorably reviewed. If you can’t afford contracts with the research companies, this can be an alternative. You can get some best practice information and peer benchmarks from vendors as well, but be mindful of the inherent bias.

Several of the major companies spend hundreds of millions of dollars on their own research and development, but your main point of contact with vendors is likely to be the sales organization. Sales does not often volunteer an engagement with R&D, but I’ve almost always found them receptive when asked. Among the best I’ve worked with are:

HP Labs When I visited HP Labs in 2003, they showed me an IPAQ PDA equipped with GPS, an internal compass, and the ability to interact with a virtual map. With the exception of the mobile phone component, it was a spot-on prediction of the location-aware mobile services we use today. The Mobile and Immersive Experience lab is doing some groundbreaking work on displays, printing, mobile devices, and social interaction. Every division has a public-facing web site and downloadable research papers, all at no charge.

IBM research is legendary. While some of the resources here are highly technical, there is a wealth of information for businesses, including the “First of a Kind” program for collaborative innovation on new products and services, and the Experimental Technology Site, which invites users to try new ideas out firsthand.

Others who are deeply involved in research include Microsoft, Alcatel-Lucent (including another R&D legend, Bell Labs), and SAP. No discussion of technology research would be complete without mention of PARC, the Palo Alto Research Center run as a separate company by Xerox. “In the business of breakthroughs” is their own description of the company; PARC invented the laser printer and the graphical user interface (the window/mouse convention at the heart of nearly all computing today.) - Communities: the tools of social networks we first used as private consumers are in wide use by professionals and businesses. You can read entire books on this topic alone--and the chances are, you’re already using some combination of these tools. For the purpose of this report, this section is a beginner’s guide: a social-network way to consume tech and business news, and to establish community with peers and thought leaders. In the case of nearly every analyst, author, or company you can follow through social channels, you will also find an associated blog or website. Twitter: for a service that conveys information in 140-character tweets, Twitter can be a truly valuable way to get breaking tech news, follow a topic of interest, and have conversations with some of the leading tech minds. It can also be somewhat daunting; the site is not inherently user-friendly, the short-entry format is awkward, and once you’re following more than a few dozen names, the information stream becomes a torrent and a distraction. There are ways to mitigate all three problems, starting with these fundamental things:

--you can follow someone by name, and see every tweet they post

--you can search by keyword. Put a “hashtag,” or pound sign, in front of search words, to see all tweets so tagged. For instance, “#ENSW” stands for Enterprise Software; you can then save the search, and generate a list of tweets any time. See Mashable’s “How to: Get the most out of Twitter hashtags” for a closer look.

--you can organize the companies and people you follow logically with lists, you can follow lists created by others, and you can share your own. You’re welcome to try out some lists I use, all of which are shared: All Tech Considered (with apologies to NPR for using their title), High Frequency Analysts (valuable, but publish so often they need their own category or their voices would overwhelm everyone else,) and The Business of Business.

--Twitter recently acquired Tweetdeck, a third-party tool to manage lists and searches by breaking each into its own column in a constantly-updating desktop or browser window. Tweetdeck can also manage and display feeds from Facebook and LinkedIn.

Facebook, Google+: Although the two competing sites might not like being grouped together, they both feature richer posts than Twitter, with the ability to incorporate photos, video, and links to websites more easily. Both offer comment threads, and the ability to feed posts to specific groups (G+ through “circles”, Facebook through user-created friend lists.) In my opinion, because of the threaded nature of comments, these are easier to follow than Twitter. Early in the life of Google +, it took on more of a business “bent” due to heavy tech community adoption, so I’d recommend giving it a try: http://plus.google.com. LinkedIn: started as a business networking site, LinkedIn can be a really valuable way to connect directly with peers, and with thought leaders. Companies can have LinkedIn identities, and share posts and discussions. There are groups as well, searchable by name or topic, or you can create one yourself. In my experience, LinkedIn groups are not often well moderated, so the value-to-noise ratio can make them a challenge. Because LinkedIn allows you to do status updates in the same manner as Facebook or G+, it can be a pre-filtered way to communicate with business contacts, a useful step. Useful advice: if you have favorite analysts within the paid research community, make a point of connecting with them through LinkedIn, Twitter, Facebook, and/or G+ while you are in regular contact. Analysts sometimes leave the companies where you know them, this protects in advance your ability to stay in touch if that happens. Quora: the value of this question-and-answer site is directly connected with the credentials of the communities of people using it and answering questions; so far, that community seems to be very professional, the dialog is high-level, and there is a great deal of self-moderating. You can follow individuals or specific questions, and see lists of others who are following them, oftentimes a shortcut to building an expertise community. YouTube: your source of videos about cute cats and flashmobs is also a huge library of free information from major tech companies, research firms, individual analysts, and universities. As a portal into this side of YouTube, visit the Infrics Channel, where you’ll find playlists by major tech topic, and subscriptions to channels from recommended sources. - Academic sources: the case for business and technology research with an agenda not driven by either a sponsoring company or the sales cycles of commercial research is self-evident. Universities are the natural source. Here are some of the ones I know: Center for Information Systems Research at MIT Technology Review from MIT Sloan Management Review from MIT Harvard Business Review Wharton School of Business at the University of Pennsylvania Center for Information Science Research in the Interest of Society at the UC system

- Conferences, and the 80/20 rule applied to research: most everyone speaks of the 80/20 rule at some point: 80% of business comes from 20% of your customers. If you would like to get a very large chunk of the value of an annual contract with one of the big research firms without spending as much, the best answer lies in foregoing the contract, but paying for some of the big events held by research companies. Here are the ones I recommend:

--Gartner’s Symposium may be one of the great bargains in the research field. Gartner lumps together nearly all the content from every specialized conference they hold each year, does a few minor updates, and packages it with some new presentations, some good keynote speakers, and flashy keynote sessions that would do a Vegas showgirl proud. Participants have access to ALL the content, including sessions they did not attend, for a year. Without an annual Gartner contract, you won’t see breaking-news reports or have the ability to talk with an analyst after the conference ends (some analyst one-on-one meetings are included during the event at no extra charge,) but you will have vendor evaluations, a lot of product comparisons, and a huge range of best-practice reports. At $3795 (2011 pricing,) it’s well under 20% of the cost of many of their annual contracts.

--Forrester’s Forum event is similar, but on a smaller scale: fewer days, lower price ($2095 for the 2011 event.)

--IDC, not big on multi-day events, does put on one of the highest-value one-day events, their annual Directions conference (usually held in March, in Boston and repeated in San Jose, CA.) Directions is notable for an morning spent predicting the coming year for tech and business, and for excellent keynote speakers in the afternoon. Among the keynotes I’ve seen at Directions are Geoffrey Moore (“Crossing the Chasm,") Nicholas Carr (“The Big Switch”,) and Don Tapscott (“Wikinomics.")

--EmTech, the emerging technology conference presented by MIT’s Technology Review magazine, is not the place to go to get vendor comparisons or best practice information. But it is the event to renew your faith in the future, and to hear important ideas firsthand from the people creating it. As an example, when I first attended in 2006, Amazon’s Jeff Bezos introduced a new service: the Elastic Compute Cloud, perhaps the very first use of the term “cloud” I ever heard applied to delivery of IT services through the internet from a third-party vendor.

An Infrics.com business research consult day: money well spent